Go solar in 2019 to take full advantage of the federal solar tax credit

(This article was updated in January, 2020)

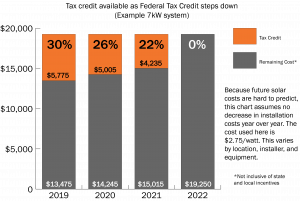

Homeowners and businesses thinking of going solar (as well as adding battery storage) should act in 2019 to take advantage of the 30% federal solar investment tax credit (ITC) before it begins to phase out. The ITC will step down to 26% in 2020 and then to 22% for 2021. After 2021, the residential credit will drop to zero while the commercial and utility credit will drop to a permanent 10%. You should check with your installer on whether they can have your system installed in time to take advantage of the 30% credit. Even at next year’s 26% rate, the tax credit is still a valuable incentive to go solar.

Through the end of 2019, the ITC allows homeowners and businesses to take a 30% percent tax credit for the cost of solar systems on their properties. This is a one-time tax credit that you receive the first year you own your solar system, and there is no cap on the amount. In addition, the IRS determined that residential solar owners may also claim the ITC for the cost of battery storage if the battery is charged entirely from the solar. This includes installing a battery system at the same time as solar panels as well as adding storage to an existing solar array. If you are unable to use the entire tax credit in one tax year, you can use the remaining amount in subsequent years.

Consumers should be aware that the IRS has not provided clear guidance on the tax credit for residential solar projects that begin but are not completed in 2019. Earlier this year, the IRS clarified the definition of “commence construction” for claiming the credit for commercial solar systems. According to the Solar Energy Industry Association (SEIA), businesses must show that “physical work of a significant nature” has started, or by “paying or incurring five percent or more of the total cost” of the system in 2019. However, according to SEIA, residential installations must be completed (the IRS code says “placed in service”) before being eligible to claim the credit. For this, as with any tax matter, it’s best to consult with an accountant for advice.

The ITC is a good example of how a well-planned tax incentive can jump start a key clean energy market. It has boosted economic growth and local jobs while promoting energy choice and independence for millions of Americans. If you are planning on installing solar (and storage) on your home and/or business, now is the time!