Virginia incentivizes businesses to go solar

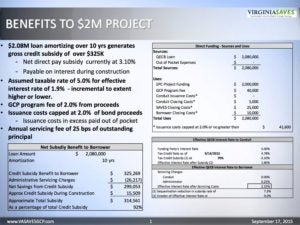

Earlier this month, Virginia launched the Virginia SAVES Green Community Program. The effort is designed to help business and local governments finance renewable energy, energy efficiency, and alternative fuel improvements. The program offers up to a 3% interest rate buy down for projects larger than $1 million dollars.

Funding for this effort comes from federal Qualified Energy Conservation Bonds (‘QECBs”). The funding provides a buy down of interest businesses or governments would pay on financing their project.

For example, a business that financed an energy project at 5%, and access the subsidy, the borrower’s net interest rate is 2%. For local government borrowers, which have been able to borrow recently in the 3-4% range, the incentive potentially affords a net interest rate of below 1%. The interest rate buy down could save a project hundreds of thousands of dollars over its lifespan.

There is a two-step application process. First, applicants have to submit a project summary to prove that it is eligible. Once it has been deemed eligible, applicants must submit a formal application. A committee will review projects based upon bankability and cost effectiveness.

Applications are being accepted on a rolling basis. The initial allocation of funds is designed to cover $20 of funding. Program officers say they have received $15 million worth of applications less than a month into the program. The popularity of the program demonstrates the high level of interest smart energy technologies, like solar, have in the state.