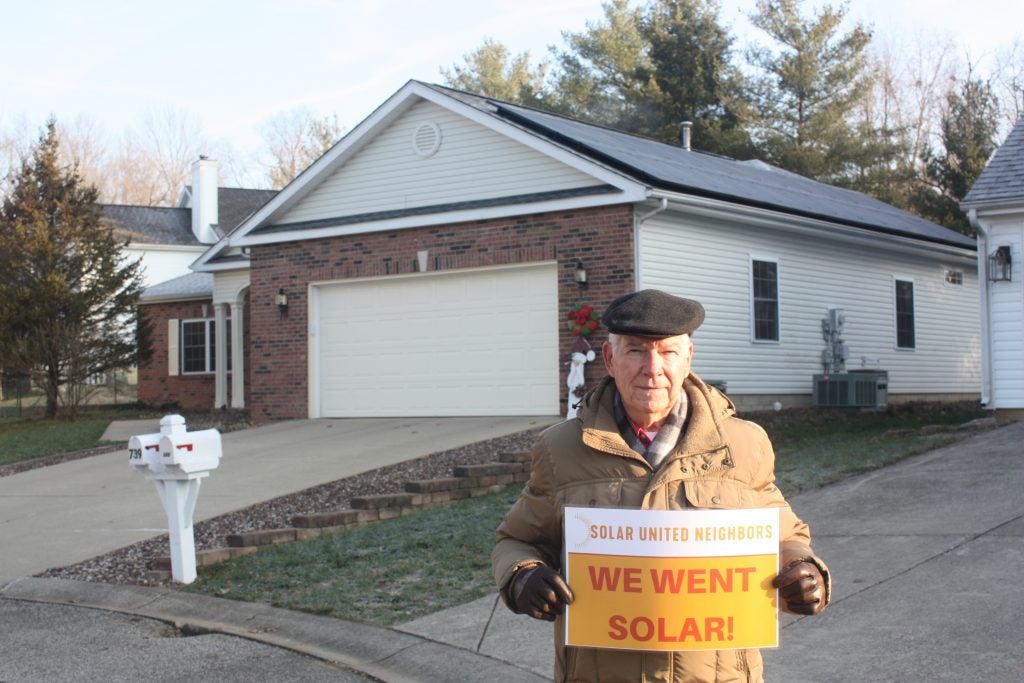

Gary – Bloomington, Indiana

I went solar after the Indiana tax credit for climate.

Gary – Bloomington, IN

System size: 7.5 kW

26 panels

Why did you decide to go solar?

We decided to go solar to help the environment and decided to go solar in 2017 because of the tax credit change happening in Indiana.

Did anything surprise you about going solar?

- Your homeowner association might have a restriction again solar panels! Ours did, and it took 6 months of campaigning to get the restriction removed before December 31, 2017.

- Before the end of the year of installation, you should file with your Indiana County Assessor (oer time only) Form SES/WPD, State Form 18865 (R11/10-15): “Statement for Deduction of Assess Valuation (Attributed to Solar Energy System or Solar, Wind, Geothermal or Hydroelectric Power Device)”. The deduction is then applied automatically in all future years.

- You must register with a broker to be compensated for the electricity produced by your system. We use Sol Systems to market our SRECS. We don’t get much excess energy produced since the summer excess energy sent to the grid is credited to our Duke account and reduce their billing for energy used at night and during the winter months. We received $14.76 for SRECs generated from April-June 2019.

Do you have any data about your solar system performance? What electricity savings have you seen since going solar?

- Duke Energy Costs for 12 months in 2017 before installation: $1,021.20 (average: 85.10/month). Except for the monthly metering service charge from Duke Energy (now $9.64 per month), no additional charges have been received from Duke since February 2018. Estimated Average savings: $75/month or $900/year.

- 1 time federal tax credit for 2017 (30%): $5,730

- SREC Payments during the 12 months ending June 2019: $65.10

- Payback in about 14 years: $19,000 (cost) – $5,730 (tax rebate) = $13,370 divided by $965/year.

What advice would you give to someone considering going solar?

Do it as quickly as you can!