Examining PSE&G’s Solar Loan program

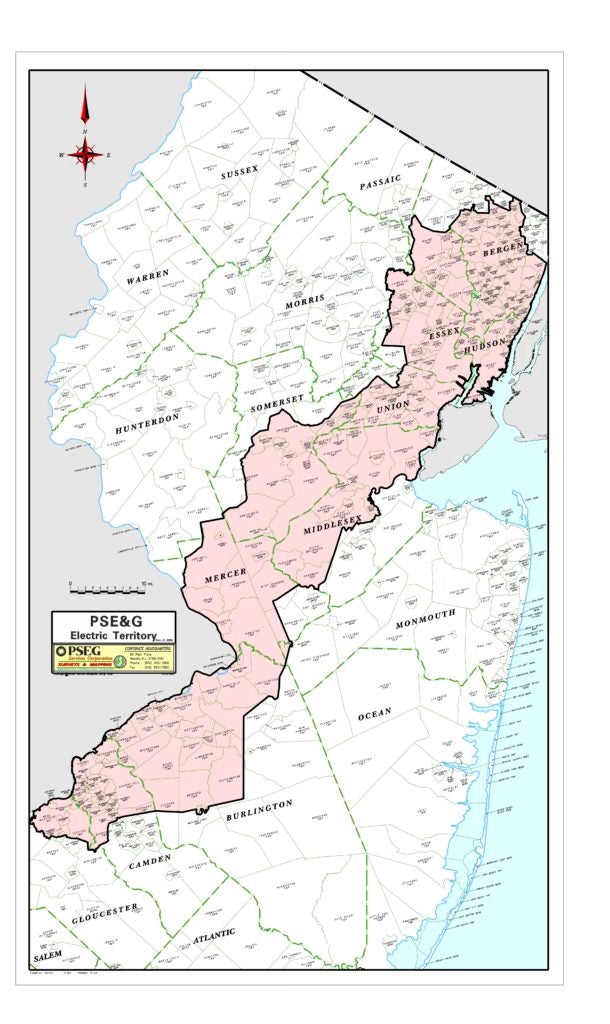

Homeowners looking to finance their solar system have many options. PSE&G’s Solar Loan program provides access to financing for homeowners in the utility’s electric service territory. Borrowers can repay this loan by cash or through Solar Renewable Energy Certificates (SRECs). The loan program has helped more than 1,000 residential homeowners go solar.

The loans have an interest rate of 11.179% and a ten-year term. Before you decide to opt for this financing route there are some things you should consider.

The loan has a $20/kW application fee as well as an $85/kW administration and a $120/kW SREC processing fee. The latter two fees are deducted from loan proceeds at closing. This means a typical 5 kW system will have a $100 application fee, $425 administrative fee, and a $600 SREC processing fee. In aggregate, that amounts to $1,125 in fees. While these fees aren’t necessarily prohibitive, given that the administrative and SREC fees are deducted from your loan, they are an additional cost to keep in mind.

If you would like to participate in PSE&G’s loan program, you should talk with your installer upfront about whether they have experience applying for the loan program on behalf of their customers. A lack of experience could translate to an unsuccessful application and/or unnecessarily high administrative costs. A few of the installers we’ve spoken with note that their staff has to spend additional time applying for the loan on behalf of the customer. This can add labor costs to the customer’s final contract price. Installers also noted that it’s imperative to have someone on staff with experience with the application. PSE&G has developed a list of companies that have installed four or more systems through the loan program (PDF).

A final thing to consider is the likelihood that you will stay in your home the entire 10-year loan period. If you move and are still under the terms of the loan, you’ll either have to pay it off or assign the loan to the home’s new owner. PSE&G will vet the new owner and determine whether they’re credit worthy of a loan assignment. Program participants must have a minimum FICO score of 680 (for salaried employees or self-employed people of more than two years) or 720 (for self-employed people of less than two years). This may limit the number of bidders you will have on your home.

More information about the loan can be found on the PSE&G website: https://www.pseg.com/home/save/solar/pdf/FAQ_current-borrowers.pdf.